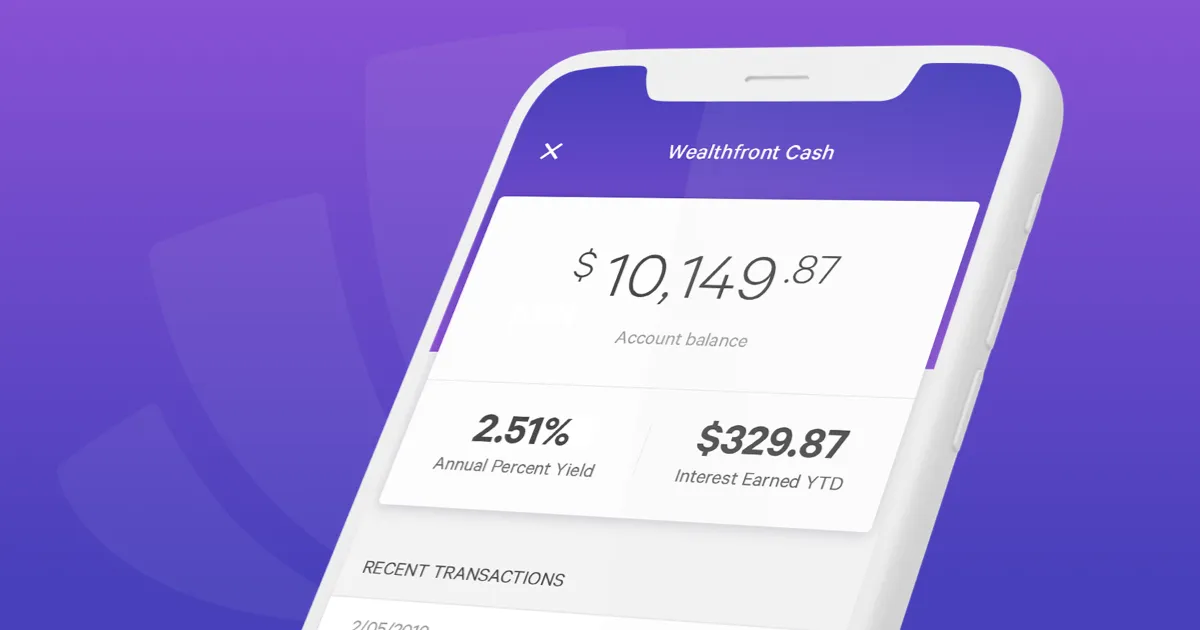

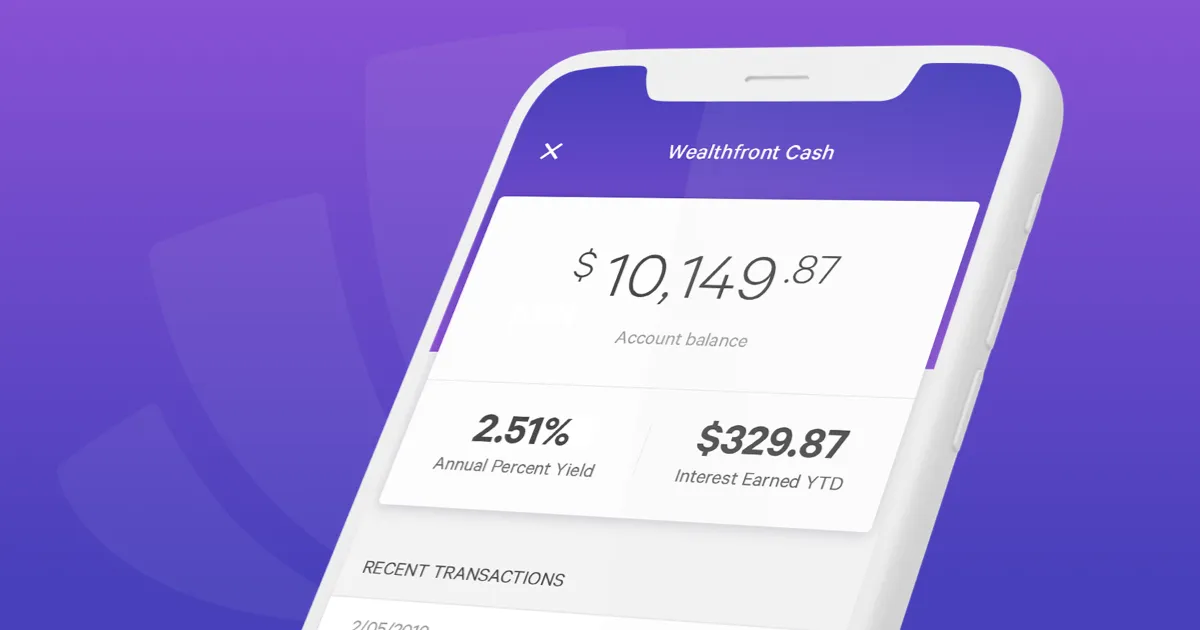

Why Wealthfront's Cash Account Is Not Safe

July 25th, 2019 · 8 min read

Have other articles like this sent directly to your inbox 📥

Sign up for my newsletter

Receive quality content on diverse topics. The premium edition, for free. 👊🏽

Receive quality content on diverse topics. The premium edition, for free. 👊🏽